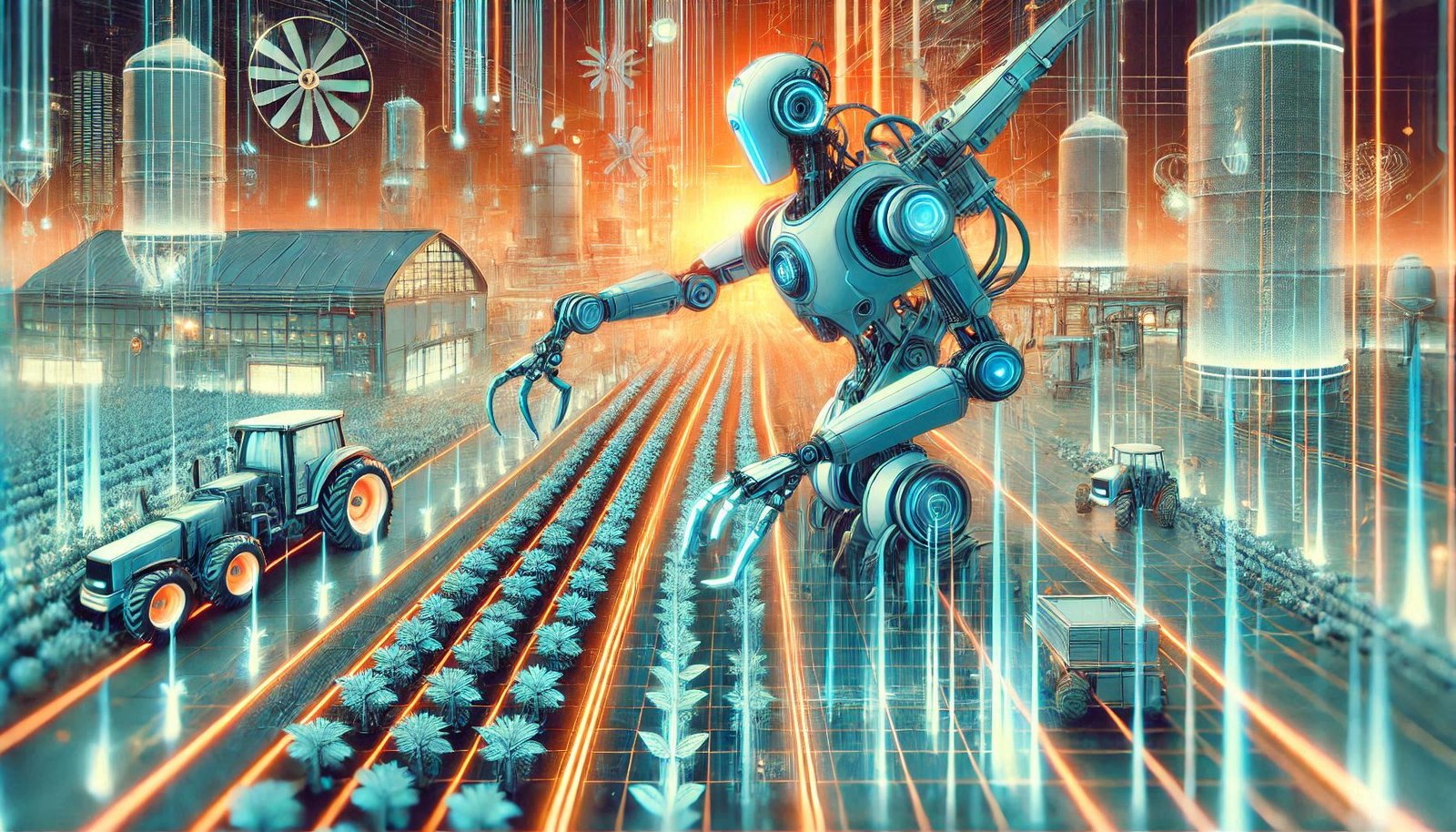

The pastoral figure of a farmer nurturing their fields stands to become a quaint relic. We’re not talking slow evolution here; we’re seeing an agricultural revolution — one powered by steel and silicon, not sweat and soil. Despite stereotypes to the contrary, the reality is that the contemporary agricultural landscape — with its labor shortages, razor-thin margins and the pressing need for improved efficiency — is ready for disruption. We have witnessed the tentative appearance of automated harvesters and GPS-manipulated tractors, but those are mere tremors preceding the earthquake. The real question isn’t whether robots will be the pillar of agriculture, but whether robots will take a central role in that effort, and when.

This isn’t idle speculation; it’s an inevitability based on cold, hard logic. The shrinking pool of skilled agricultural workers, along with the need for higher production to feed a growing globe, is driving a move toward automation, he said. Asserting that robots will merely augment human labor is naive at best and deliberately misleading at worst. The efficiency gains, the precision applications of inputs, the 24/7 operational capabilities offered by robotics are simply insurmountable advantages that will, and should, displace traditional methods. We are not just making a point about robots versus humans; we are talking about the evolution of a whole industry. This transformation will not come without its challenges to address — questions of retraining the work force, how to fund the upfront investment, and peers in the industry resistant to practice-changing principles must be confronted. But then again, the future of food production is absolutely, without a doubt, robotic — and anyone who thinks they can ignore this tectonic shift is going to get left out in the dust of progress. This isn’t a prediction; it’s a trajectory we are already traveling. Now it is time to know the forces at work and position strategically for the new age of agriculture.

Thesis: The agricultural robotics market is set to explode with transformative trends, but smart strategizing is critical to leverage the positive side and mitigate adverse ones. This one is not just observation — it slices into the drivers and serves up insights you can use to win.

Positive Trend #1: The Revolution of Precision Agriculture (Opportunity)

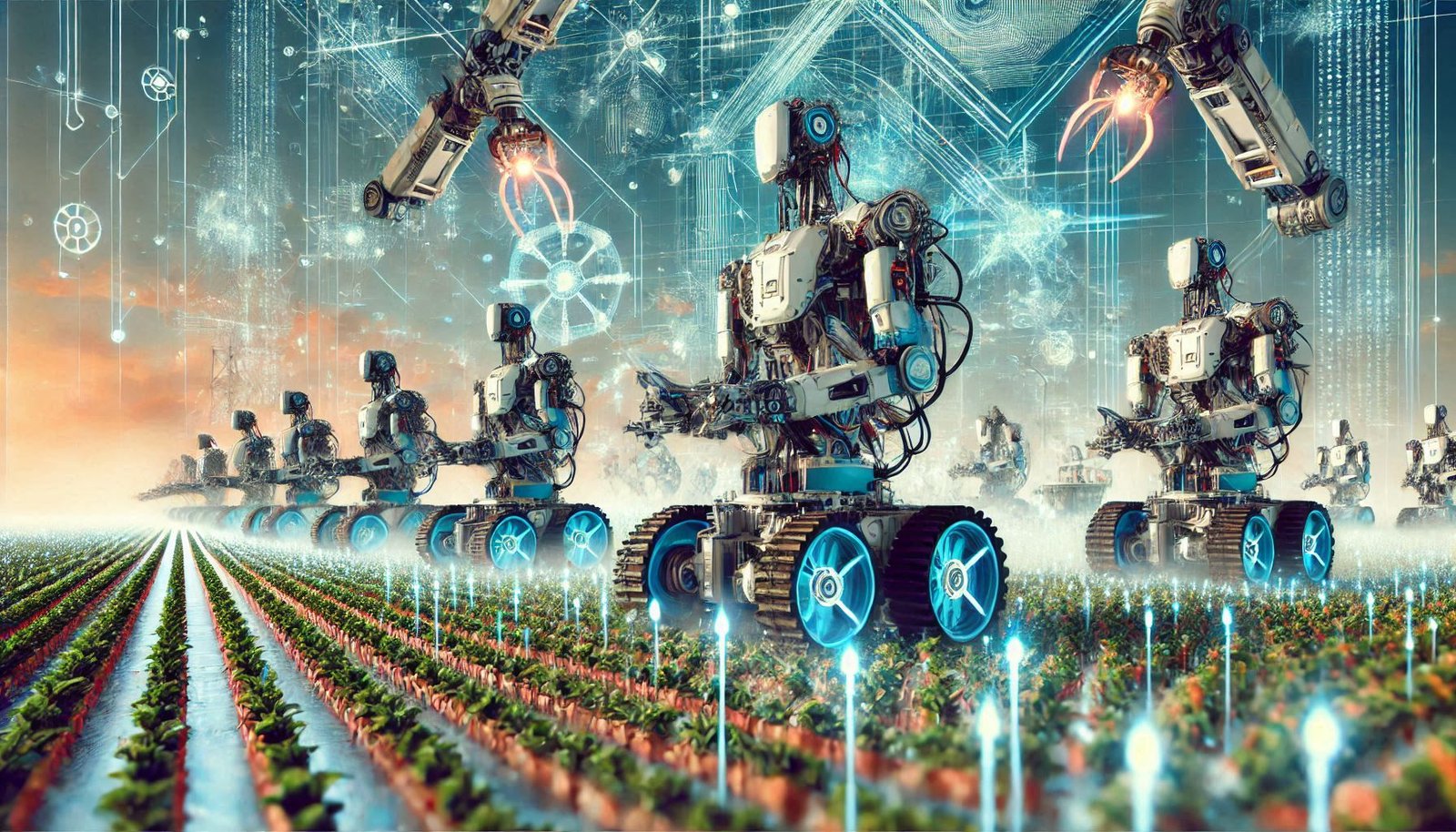

The transition from broad-acre to precision farming fuel-air for robotics: analysis Site-specific management—monitoring individual plants, optimizing resource allocation, and implementing targeted interventions—attracts the need for automated solutions. Plausibly a world where robots deliver fertilizer precisely to plants that need it, reducing waste and environmental impact, enormously. Company Blue River Technology (which was acquired by John Deere) and FarmWise are successfully using AI-powered image recognition to explore this approach — they are creating autonomous weeding robots. This shift isn’t just about tech; it’s about a more sustainable and efficient food system.

- Impact: Companies that can build or integrate robotic systems for precision tasks will capture a disproportionate share of the market.

- Strategic Insight: Allocate significant resources to AI-image recognition and automation development to meet site-specific requirements. Put data collection and analysis capabilities at the top of your list.

Trend 2: Persistent Labor Shortages, & Cost Pressures (Opportunity)

Analysis: With labor shortages hitting the global agricultural sector, tough working conditions and an aging population of workers are aggravating. At the same time, farmers are under pressure to cut costs and boost yield. Robotics provide a powerful dual solution, serving as an automator for harvesting, planting, and other labor-intensive tasks. Agrobot is one of them, utilizing robots for harvesting strawberries which can significantly reduce dependency on manual labor. It’s a question of survival, and robotics can be a strong lifeline.

- Specialization and industrial networking (solutions) of robotic solutions that diminish operational costs and labor activation limits will take the lead.

- Takeaway: Develop your robots to be affordable, robust, and easy to use — and aim them squarely at a labor-intensive task. Partner with growers to make sure that the tech is farmer-friendly.

Negative Trend 1: Cost of entry is relatively high to begin with.

For many farmers — particularly smaller operations — the upfront costs of agricultural robotics systems can prove prohibitive. This creates a major uptake obstacle. Not only an issue of technology, but finance that could fundamentally establish a 2-tiered system in which only the largest firms could afford automation.

- Effect: Slower adoption rates, market consolidation toward larger farmers who can afford the systems.

- Actionable Insight: Consider alternative financing models, whether leasing, RaaS (robot-as-a-service), or shared-use platforms to reach a broader spectrum of farmers.

Adverse Trend 2: Lack of Standardization and Interoperability (Challenge)

Analysis: The introduction of no standard means of interoperability. This can make the implementation of overarching solutions difficult to adopt, as integrating disparate systems from different vendors can be a cumbersome and costly process. And this creates an artificial roadblock to the agricultural robotic market of reaching its full potential.

- Impact: More expensive integrations, less flexibility in systems, delayed development of holistic agriculture solutions

- Actionable Insight: Take an active role in industry partnerships that define standards for interoperability. By investing in open platforms and APIs compatibility, different robotic systems can seamlessly be integrated together. All of this is a call for collaboration, not competition.

Final Words: Robotics is the future of the agricultural industry. SIPPER folks know that the strategic success is dictating the powerful positive trends to take over from precision agriculture coupled with labour shortages, while aggressively mitigating challenges like high initial cost coupled with lack of interoperability. But businesses that are nimble, adaptable, and open to novel financing models and cross-sector collaboration will not only weather the storm, but will also excel in the new era of agricultural robotics. The opportunity is there in spades; the future favors the bold.

- Robotic arms with state-of-the-art vision systems are making a name for themselves in the seed business, massively boosting yield and efficiency. Companies such as John Deere are rolling out autonomous tractors that use GPS and computer vision to drop seeds down to millimeter precision. At scale, this tech saves seed—reducing waste and ensuring plants are spaced appropriately—which translates directly to the bottom line for large scale farming operations. Now imagine the competitive advantage this gives, far superior to manual processes, more crop yields and lower input costs, really solidifying a competitive advantage to early adopters.

- In pest control, autonomous spraying bots are fast becoming essential. Blue River Technology (owned by John Deere, order two please) uses computer vision to spot weeds and then apply just the right amount of herbicides that are needed, saving up to 80% in chemicals. It’s not only about saving money; it’s an evident display of sustainability and environmental stewardship that appeals to the mindful shopper. Consider how a company could benefit from “eco-friendly farming,” knowing that it built a brand around shrinking the use of chemicals — that’s a tremendous marketing advantage and a differentiator.

- Robots are now gently harvesting the fruit and vegetables. Agrobot and other companies make robotic harvesters that use advanced sensors and Ai to identify ripe produce, plucking carefully without nerf gloss. No, this isn’t sci-fi fantasy land, but a response to labor shortages and the need for reliable harvest timeframes. Think about how robotic harvesters are operating 24/7, compared to the seasonal, inconsistent work of the human labor that will will be very prone to cycles of high demand and low availability, you are creating a system that is making predictable outputs and operating on reduced risk. The switch to robotic harvesting isn’t a question of if, but rather when, and early investment will put any company in a good position to dominate in the next era.

- Dairy operations are also being transformed by robotic milking systems. Thus, Lely and DeLaval dominated this automated milking process market, resulting in enhanced milk production and cow welfare. These systems automise these labour-intensive aspects of dairy farming while gathering information on every cow — helping a farmer make informed decisions about health and nutrition for their herd. This goes beyond replacing labor; it’s about making every decision fact based, eliminating assumptions and optimizing the performance of the entire herd. Failure to implement data-driven operations will result in lagging so behind in an increasingly competitive landscape.

- Thesis Statement:Agricultural robotics companies are implementing various organic and inorganic strategies, as of 2023, that aim to strengthen their product capabilities, expand into new markets, and consolidate their positions via partnerships and acquisitions.

- Novel Strategies: A major organic strategy is better technology development and product diversification. Companies such as Agrointelli have dedicated research time to the robotics surroundings to enhance the efficiency and precision of their robotics for task such as weed detection, AI, and targeted spraying. This caters directly towards the necessity of sustainable farming practices for efficient use of resources along with the decreased consumption of chemicals, ultimately based on growing consumer demand. In the same vein, FarmWise is expanding beyond weeding — focusing on harvesting applications, taking their existing robotic foundation and had them on capturing new segments of and revenue streams. There is continuous improvement and differentiation along changing farmer needs and industry trends thanks to internal investments in R&D.

- Partnerships: Partnerships and acquisitions signify inorganic growth. The Future of Agriculture and AutomationIntegration of Robotics with Existing Equipment: An example we recently experienced was the 2023 partnership of John Deere with Bear Flag Robotics, which is already providing capabilities for tractors to work without operators in the fields. It enables existing players to onboard robotic technologies both quickly, and the struggle with integration with their existing workflows is solved. Another is the rise in acquisitions of small robotics companies with niche technologies by large agricultural machinery companies, which further consolidates the field. These acquisitions give access to new software, hardware, and talent, speeding up the process of technology integration. The inorganic strategies reflect a broader industry trend of seeking to scale innovation and bring automated solutions quickly to the farming sector.

- It can be easily argued that certain organic strategies are indeed tied in manifested outcomes to their inorganic styles (partnerships can inject new tech into your mix and are thus a version of this “diversification”), but keeping them distinct allows us to see these as two separate paths, one internal and one external to the organization, with different goals of advancing the organization itself. This approach is a transparent display of the state of play, where the companies bear the brunt of the ingenuity and the benefit of market penetration is being shared, which is a privilege.

Outlook & Summary: The Inevitable Harvest

Let’s be blunt: the issue is not whether robots will displace farmers, but when and to what extent. The agricultural sector, which has been due for a technological refresh long before computer algorithms or Instagram were ever even a thing, is now set for a robotic revolution bigger than anything we’ve seen in other industries. These are not incremental advancements; in the next 5-10 years we are likely to see swarms of autonomous bots taking care of tasks ranging from precision planting and targeted weeding to automated harvesting and livestock management. The consumer robotics industry stares into the ‘uncanny valley,’ but agriculture is a much more forgiving and commercially viable application space. Here, it is not emotion but efficiency that rules. This change was forced by the undeniable pressures, of feeding one growing population, but also with the economic reality check of labor shortages and expensive feed and seed. Some may harbor sentimental ideas about the family farm, but history tells us resistance to technological advancement is a losing proposition. The logic is undeniable: robotics provide unmatched precision, cost savings, and scale. What’s going on in agriculture is a microcosm of what’s occurring with automation in robotics more generally — and it’s happening at a scale — and with an immediacy — that even grizzled drones and robotics pros should pay attention to. We’re seeing not only a disruption in farming, but a fundamental rethinking around how food is produced. No, the future is not literally automated tractors, but intelligent and interconnecting systems that optimize crop yields across large landscapes.

So, knowing this already, get ready to lead or be left behind while the machines take hold of our fields.